Dearest Rachel –

It’s incredible to realize that only a month ago, we were all gathered at dad‘s bedside while he went over with us where he kept instructions pertaining to his funeral. We really thought – as did he – that he would hang on just long enough to see his way through Christmas (possibly even New Year’s) and then let go.

That day will come, eventually – it will come for us all, after all – but it was not then, and it doesn’t seem to be any time in the near future, praise God.

Now, however, he’s gotten to the point where it’s clearly a matter of when rather than if he’ll be able to leave the convalescent place and settle back into his real home. In the process, the things that he concerns himself with have changed; rather than concerning himself with things to come after himself, now he’s doing his level best to make sure that Mom knows how to assemble everything to be forwarded to their tax professional, just in case he’s not there yet. “I’ve tried to show her where everything is in the past,” he says, “but until now, all she’s ever said to me is. ‘Oh, I trust you to do that.’ Which is nice that she does, but she’s got to be able to do this herself at some point. If nothing else, I’m not going to be able to go downstairs” which is where their computer is “any time soon.”

He’s still trying to get things in order, but as his situation improves, the things he’s trying to get in order have changed. I don’t know if this is just from no longer being at death’s door, or if it’s just a matter of the time and season; the turn of the year does lead into tax season after all (which may get my attention simply because of my profession, perhaps).

It may also have something to do with the fact that, since I’m going to be out of town (to put it lightly) when everything is due, I have to worry about teaching someone how to assemble tax documents, too. Actually, you might find this rather amusing, as we used to read (and watch) memes together back in the day; one common theme was that of how kids would like to learn how to deal with taxes in school, only to be told, “Best I can do is the quadratic formula/that the mitochondria is the powerhouse of the cell/some other seeming useless nonsense you ‘learn’ in school.” Of course, let’s be honest here; kids would be bored out of their minds trying to understand the intricacies of the tax codes – and the fact that they differ, sometimes wildly, from state to state (not to mention from year to year) would make it prohibitively difficult to set up a curriculum that would be sufficiently profitable for textbook writers and such – so it will never happen, and they’ll never be ready for it when they have to deal with it in real life.

It would be funny, though, for some school to put together a rudimentary sort of class to discuss such things, on an elective basis, just to see how many sign up for it, only to get some grizzled coach type explaining that taxation is theft, and going into details as to how by showing them his paycheck or something.

I digress. Sorry, honey; as I start telling you about these things, my mind wanders, and lets my fingers type all sorts of strange things.

What I need to get back to is the fact that I spent a couple hours yesterday with Daniel trying to determine if he’d gotten any separate requests from our prep team for documentation for his own taxes. I don’t mind telling you that it was scary to see the red dot on his email app that had extended into a large oval; he had over sixty-five thousand unread emails waiting for him. Granted, most of these were junk, and he acknowledged that he needs to figure out a way to filter and file the notifications he gets from certain other apps that he’s subscribed to, but it was still daunting to see for somebody like myself, who makes sure every day that everything gets looked at, and either filed away or dealt with.

The good news is that, with electronic mail, it’s easy to search through, unlike with paper documents. All I had to do was look for the name of the sender, and I could verify the last time he received anything from our tax team was in March of last year (and even then, I was copied on it, so it’s long since been addressed). So I’m getting everything that goes through for the two of us; nothing is slipping through the cracks by going to him alone.

Still, there is the question of his bank accounts, and I had to make sure that he could get into the online access portals. The bad news is, his computer seems to have problems getting through the authentication page. The good news is, everything is set up on the computer in our upstairs office, so he should have no trouble downloading his 1099s and forwarding them on to me to upload with our tax team after all. Who knows? Maybe someday he can do this on his own; eventually, he’ll have to, as I assume he’s going to outlive me. But for now, this is good enough.

Also good enough is the fact that he has sufficient ready cash in the one bank account that he can take care of the few bills that still come around in the regular mail while I’m out of town. After all, since he will be enjoying the benefits of those various utilities (and I won’t be), it should fall upon him to pay for them. The funny thing is, it doesn’t bother him so much to pay for these things – he actually offered to pay for the phone/internet bill that had arrived yesterday, which I told him would be one of the things he would have to take care of in my absence – as it does to actually write the darn checks. He’s had trouble in the past few months knowing where to put everything on the check, and often asks why, if he writes the number down, he has to literally spell it out elsewhere on the same piece of paper – which, admittedly, I’m not entirely sure about myself.

The irony is, I think I remember having a class in high school that actually went over this sort of thing – how to write a check, for instance – but I guess Daniel never got the benefit of something like that. It’s why I picture what I do when I describe this elective tax class, by the way.

At least we should be able to communicate over the internet if he has any difficulties, and when the 1099s arrive, I’ll probably be at sea anyway, and not particularly pressed to be running around some port of call or another. So I think that the two of us are good to go for now, more or less.

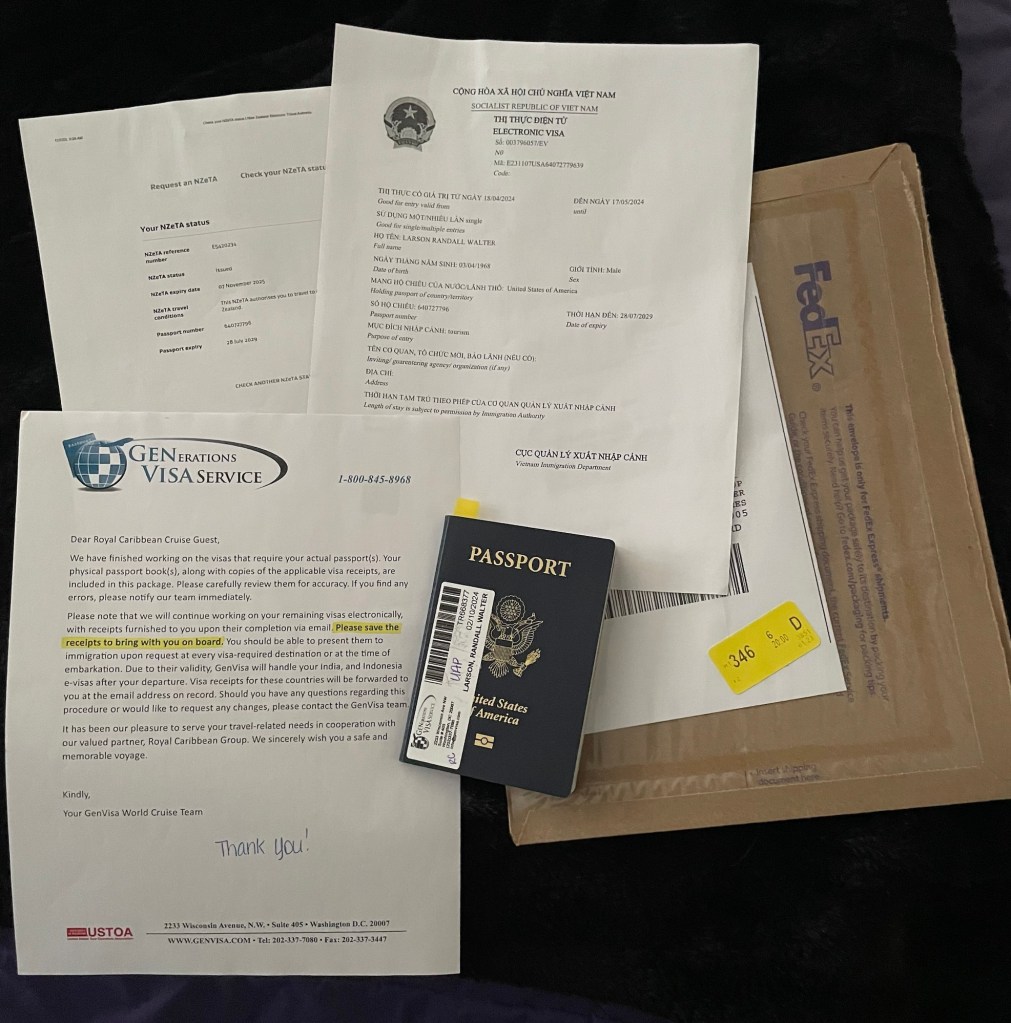

And on the subject of both being good to go, and having papers in order, just as I was about to retire for the night last night, I spotted a FedEx envelope that Daniel must’ve brought in while I was either visiting dad, or working in the office yesterday:

That’s right; after just a little more than ten weeks – which is essentially how long I was told it was going to take, so I can’t exactly fault them for the delay or anything – I’ve gotten my passport back, along with a visa or two. The team is still working on a couple of them (even while I’m aboard ship), but considering how long it will be until I get to those places, there shouldn’t be much of an issue of them being taken care of before I land there.

So there you are; yesterday was a day for taking care of a lot of things that need to be dealt with (or at least put in motion) before I leave. Things are beginning to look well in hand – or at least, considerably more so than they had barely twenty-four hours previously.

All the same, honey, if you could keep an eye on me (and Dad, and Mom, and Daniel for that matter), and wish us all luck, that would be appreciated. We’re going to need it, after all.